All About Fraud Alerts

March 17, 2023

OFCU offers free fraud monitoring and automated fraud alerts with our debit cards. Your card activity is monitored to identify transactions that may not be within your usual patterns. If we suspect a transaction may be fraudulent, we will flag the transaction for verification.

Who gets fraud alerts?

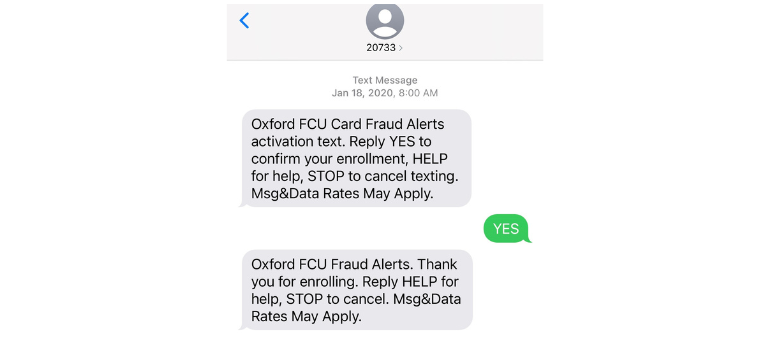

When a member opens an account and is issued a debit card, if there is a cell phone number on their account a text will automatically go out to ask if they would like to enroll in fraud text alerts. A ‘YES’ reply will complete the enrollment. If the invitation is declined or not responded to, a phone call will be made when a transaction is in question.

How do fraud alerts work?

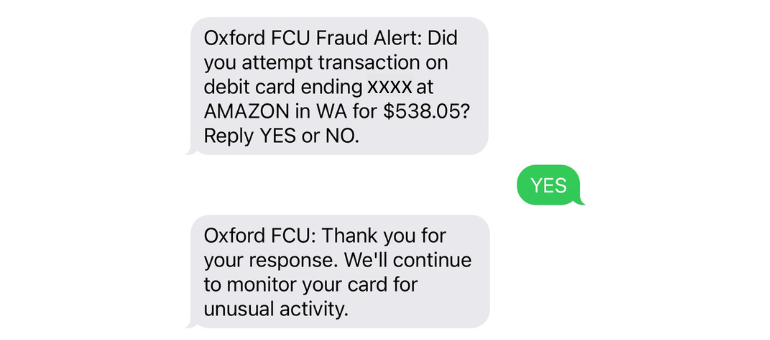

A text message will be sent to your mobile device when a suspicious transaction is identified. Simply reply to the text to confirm whether or not you recognize/made the transaction. If you did not, you will receive a text asking you to call 1.877.253.8964 for further assistance. There will be a block placed on your card to protect you from further fraud until you are able to contact us. If you reply to the text confirming the transaction, your card will remain available for use.

If you do not reply to the text within 30 minutes, an automated phone call may be made to the mobile device and/or home number listed on your account. If you receive this call, listen to the prompts provided to confirm or deny the transaction in question.

What can trigger a fraud alert?

• Transactions that are made outside of the United States. Always let us know when you are planning to travel - even within the country. Irregular spending can trigger an alert.

• Transactions that are declined because the PIN, expiration date or CVV code are incorrect.

• Multiple attempted transactions within a short period of time.

• Transactions that are outside of your normal activity.

Personal note: I received a fraud alert in January immediately after I purchased a new laptop from Amazon. I thought it was weird, because I shop on Amazon A LOT. Then I realized that the dollar amount was significantly higher than my usual purchases and that is what triggered the alert. That actual alert is in the image at the top of this article as a sample of what one looks like.

• OFCU also sets restrictions on cards when we are aware of a current fraud trend that could affect members.

Beware of fraudulent (fake) fraud alerts!

Last fall, a member received a text alert (from 'OFCU Employee') asking them to verify a possible fraudulent transaction. The text contained a code and a phone number to call. They called the phone number and put the code in when prompted - then was asked to enter the PIN for their debit card. Unfortunately, they entered that, too.

Legitimate text alerts from OFCU will ONLY ask you to confirm "YES" or "NO" regarding a suspect transaction. If you respond “NO" (I did not authorize this transaction) you will receive another text asking you to call. If you respond “YES” you will receive a text thanking you for confirming the transaction.

If you receive a suspicious 'alert' from someone claiming to be a representative of OFCU, be sure to contact us directly before responding in any way. If it is outside of business hours, call the fraud line directly at 1.877.253.8964.

Are you getting fraud text alerts for your OFCU debit card?

All new cardholders receive a text invitation to activate alerts when their card is issued (see image below). If you missed yours, or didn’t know what it was for, give us a call - we can initiate a new invite for you today!